(CLICK ON CARTOON TO ENLARGE)

Updated below:

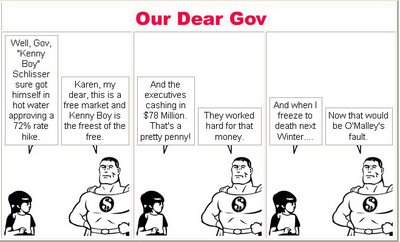

I'm having a really hard time getting myself around this controversy. As usual in Maryland politics, everyone blames everyone else. I think the latest is that Ehrlich has called a special session of the Assembly to deal with a scheduled 72% hike in Baltimore Gas and Electric's rates. It is also tied into the famous "deregulation" that was supposed to solve the World's problems (it sure hasn't worked with airlines).

If you are interested in this controversy it is dealt with in a number of places including:

BaySense

Free State Comment

Chron.com which reports these interesting details:

BGE, Maryland's largest utility, is under fire for the rate hikes. The power supplier released financial data to lawmakers this week.I have only one word for this: "Ouch"

The numbers showed that BGE bought 70 percent of its power supply from Constellation Energy Group, which is BGE's parent company.

In financial details sent to the legislature's ruling Democrats, the company also said its power plants are valued at $4.3 billion and that 13 executives could cash in as much as $78 million in stock options when the company merges with a Florida utility. (emphasis added)

The Baltimore Sun

The League Reassembled

I just find it fascinating that someone can make millions at the same time that they are sinking the screws into the public. Then there is BG&E's CEO Mayo Shattuck:

In a separate agreement dated Friday - the same day that the state Public Service Commission approved a controversial rate plan for BGE customers - Shattuck also agreed to waive a $15 million severance payment designed to protect him if he is fired or his duties diminish after the merger.What in the hell is wrong with our country.

The agreement was among several complex maneuvers spelled out in an amendment to Constellation's annual report filed with the SEC yesterday. The document also shows that Shattuck earned a $1 million salary last year and a $3 million bonus.

At the request of the board of directors, Shattuck and other executives also cashed out tens of millions in stock options last year that would have triggered high excise taxes after the merger.

For Shattuck, options worth nearly $44 million were converted to 416,000 shares of stock, which would be worth more than $22.4 million at yesterday's closing price of $53.95 per share. Those are shares Shattuck accumulated before the merger announcement and are unrelated to the deal. After the exercise of those options, Shattuck was issued just over 1 million new options to replace those exercised. (emphasis added)

Attention Mr. Schissler, what part of P-u-b-l-i-c

S-e-r-v-i-c-e-s Commission don't you understand?

Update: ChesapeakeBlue directs us to a good summary of this situation in the Baltimore City Paper.

2 comments:

Dr C.,

Thanks for this information about a topic that is a hot button for me!

Apparently the aftermath of the Enron fiasco sent the wrong message. They can get away anything, take the money, (maybe do the time), and go right on bilking the public. And the regulatory bodies that are supposed to be there to protect consumers will not just look the other way, they will lend their assistance. Now more utilities are beginning to emulate!

I live in a rural part of Oregon where we are lucky enough to have a public utility district. It was not easy to get it created. It took a broad citizens' movement more than 20 years ago that had to fight off charges of being "communists" along with having to issue constant corrections of misinformation published in the press.

I suspect it would be much harder to put in a public utility now because in today's America you would not get major media support, but I am wondering if any moves are being contemplated in that direction?

If there are, support them full bore!

btw, I came here from markfromireland's blog, following his link.

The Baltimore City Paper has a pretty good history on this issue, here.

Post a Comment