Main Entry: gouge

Function: transitive verb

Inflected Form(s): gouged; goug•ing

1 : to scoop out with or as if with a gouge

2 a : to force out (an eye) with the thumb b : to thrust the thumb into the eye of

3 : to subject to extortion or undue exaction :

(While it is pretty clear that #3 is what we are dealing with, I’m sort of partial to 2a, colloquial GOPese you know.)

First let me remind you of this quote from our Dear Leader on 20 April, 2005:

Here at home, we'll protect consumers. There will be no price gouging at gas pumps in America.Well we’ve all heard that up is down before, but this is pretty blatant. Unfortunately, I have to take you through some statistics. (Lies, damn lies, as Mark Twain would call them). Let me make this as simple as possible so even I can understand it (click graphics to enlarge; yes, I did the graphics):

Oil Production:

Alright, that’s pretty simple, oil production in the world is increasing at a pretty slow rate over the last 25 years. Next we have oil consumption :

Alright, that’s pretty simple, oil production in the world is increasing at a pretty slow rate over the last 25 years. Next we have oil consumption :

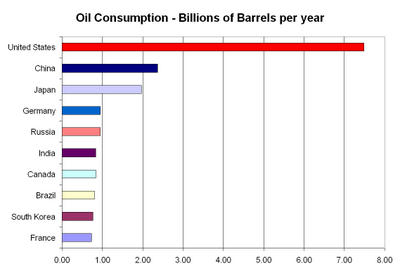

This seems right because we consume about ¼ of the oil produced every year (we only have 5% of the population but that’s something our children are going to have to deal with along with social security).

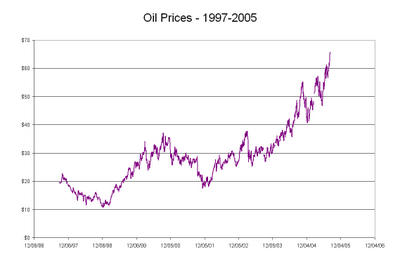

Now the going gets a little tougher. Next we have the price of a barrel of crude oil:

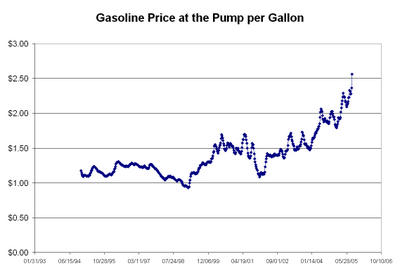

As almost every person in the United States over the age of 16 knows, the price of a gallon of gasoline at the pump is anywhere from $2.55 to over $3.00. In 2002 it was still at $1.35 a gallon.

Well, the first thing you need to do is look at the three graphs: production, price of crude and price of a gallon of gas. Why is it that even while production is increasing, the price of a gallon of crude triples and the price of a gallon at the pump more than doubles? Well, we all know the answer to that, its because the oil companies will charge what the market will bear.

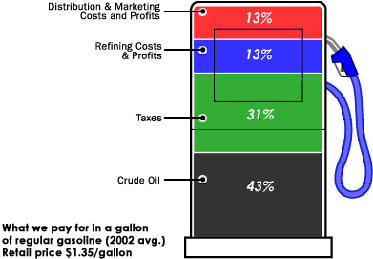

Now comes the hard part. From “How Stuff Works” I got this graphic:

This allows us to make some calculations. First of all, one has to make some assumptions.

1. Assume that state and federal taxes remain the same (they do). In the State of Maryland these are fixed not by the price of a gallon of gas (like if you were buying anything else) but at a set rate. This rate is $.184 per gallon Federal tax and $0.235 per gallon Maryland tax for $0.42 per gallon (the national average).

2. Assume that Distribution and Marketing Costs are remaining constant or increase at a low rate, say 2% a year. In 2002 these were 13% of $1.35 or $0.175 per gallon. Allow $0.20 per gallon.

3. Assume that Refining Costs and Profits (more on this later) are remaining constant or increase at a low rate, say 2% a year. In 2002 these were 13% of $1.35 or $0.175 per gallon. Allow $0.20 per gallon.

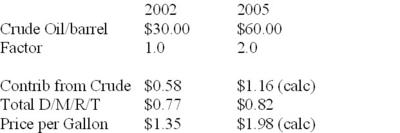

Placing this in a table for a gallon in 2002 and 2005 except for Crude Oil:

Now, of course, the big increase between 2002 and 2005 has been in Crude Oil. As Can be seen from the graphs above, the price of Crude has gone from an average of $30 a barrel to $60 a barrel.

Now, of course, the big increase between 2002 and 2005 has been in Crude Oil. As Can be seen from the graphs above, the price of Crude has gone from an average of $30 a barrel to $60 a barrel. A barrel of crude makes about 20 gallons of gasoline (plus a lot of other things.)

Putting this into a new table and observing from above that in 2002 43% of the price of a gallon of gasoline was due to the price of Crude oil:

The actual price of gasoline at the pump is anywhere from $2.50 to $3.00. When Mr. or Mrs. America fill up their SUV at the Mobile or BP (Thank you Condi) gas station, their 20 gallons costing them over $50.00 of hard earned cash generates

TEN DOLLARS EXCESS PROFIT!

Where is this money going?

Well, there is a very good reason why Dick Chaney retains his interest in Halliburton:

Big oil hits the jackpot

High price per barrel is gushing windfall profits

BY STEVEN MUFSON

08/14/2005

There's no question that the drain on the average American's pocketbook has been a gusher for the big oil companies. Just look at the financial statements issued at the end of July.

Exxon Mobil Corp.'s second quarter earnings climbed 35 percent from the second quarter of 2004 (after excluding special items) to $7.64 billion. BP PLC, the world's second-largest publicly traded oil company, said its net income increased 29 percent, to $5.59 billion. At Royal Dutch Shell PLC, second-quarter profits rose 34 percent to $5.24 billion. ConocoPhillips, the third-largest U.S. oil company, reported an eye-popping 51 percent jump in earnings, to $3.14 billion. (emphasis added)

Mr. and Mrs. America, you are getting screwed.

1 comment:

Pretty nice work there Doc.

I have made my coworkers take a gander at this which wasn't easy as they all think I'm a radical leftwing nutjob.

They were impressed as well. I can tell because they were all very sad looking after checking it out.

Post a Comment